Refind Realty Blog

Common Closing Costs to Expect in Dallas

Common Closing Costs to Expect in Dallas

By Steven Thomas, Refind Realty

Hi, I'm Steven Thomas, a Dallas-based real estate agent with Refind Realty. If you're planning to buy a home in Dallas, it's important to understand the closing costs involved. These costs can vary, but having a clear picture can help you budget effectively and avoid surprises.

What Are Closing Costs?

Closing costs are the fees and expenses you pay when finalizing a real estate transaction. In Dallas, these costs typically range from 2% to 6% of the home's purchase price for buyers . For sellers, closing costs can be higher, often between 6% and 10% of the sale price, primarily due to agent commissions .(Ramsey Solutions)

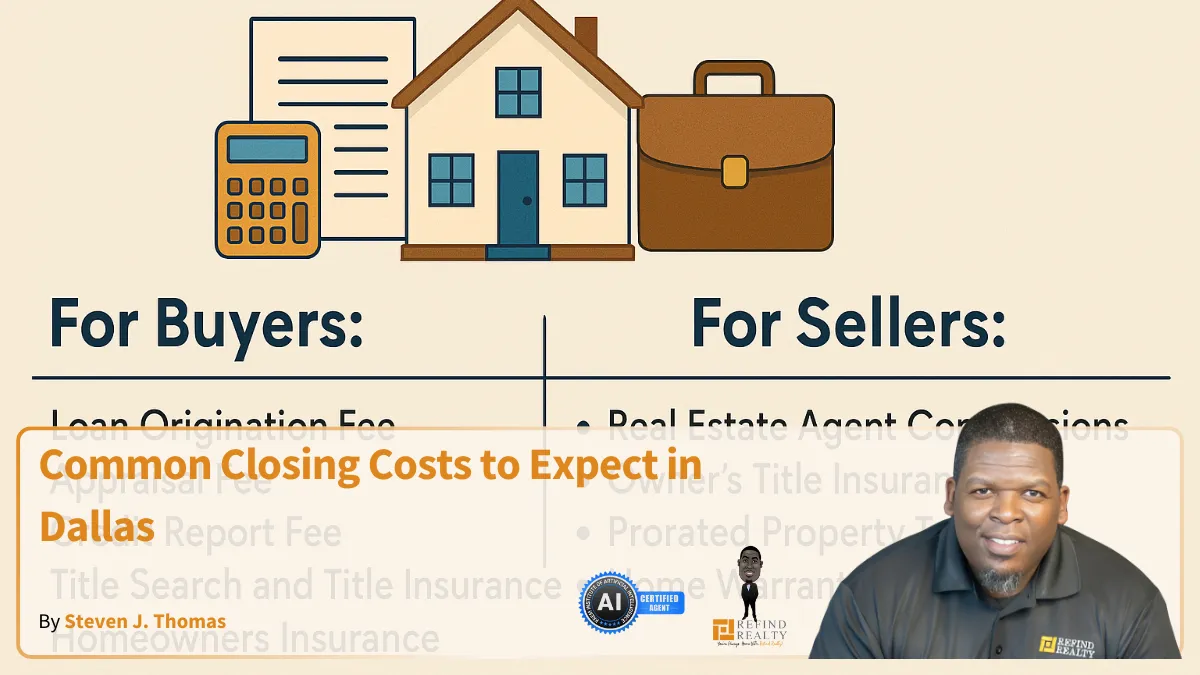

Breakdown of Common Closing Costs

For Buyers:

Loan Origination Fee: Charged by the lender for processing your loan, usually about 0.5% to 1.5% of the loan amount .(Houzeo)

Appraisal Fee: Pays for a professional appraisal of the property, typically between $300 and $600.(greysq.com)

Credit Report Fee: Covers the cost of pulling your credit report, ranging from $10 to $100.

Title Search and Title Insurance: Ensures the property's title is clear of any liens or disputes. Title insurance rates are regulated in Texas, and the cost depends on the home's price .(Herring Bank)

Homeowners Insurance: Required by lenders to protect against potential damages. The cost varies based on the property's value and location.

Escrow Fees: Fees paid to the escrow company for handling the closing process.

Recording Fees: Charged by the county to record the property's deed and mortgage documents.

Prepaid Property Taxes and Interest: Covers property taxes and mortgage interest from the closing date to the end of the month.

Home Inspection Fee: While optional, it's highly recommended to identify any potential issues with the property. Costs typically range from $300 to $500.

For Sellers:

Real Estate Agent Commissions: Usually the largest expense, typically around 6% of the sale price, split between the buyer's and seller's agents.(Kiplinger)

Owner's Title Insurance: Protects the buyer against potential title issues. In Texas, the seller often pays for this.(Reddit, Herring Bank)

Prorated Property Taxes: Sellers are responsible for property taxes up to the closing date.

Home Warranty (Optional): Offering a home warranty can make your property more attractive to buyers.

Tips to Manage Closing Costs

Shop Around: Compare fees from different lenders, title companies, and insurance providers to find the best rates.(Houzeo)

Negotiate: Some closing costs are negotiable. Discuss with your real estate agent about potential concessions from the seller.

Understand Your Loan Estimate: Lenders are required to provide a Loan Estimate outlining the expected closing costs. Review this document carefully and ask questions if anything is unclear.(Investopedia)

Final Thoughts

Understanding closing costs is crucial in the home buying or selling process. Being prepared can help you avoid unexpected expenses and ensure a smoother transaction. If you have any questions or need assistance, feel free to reach out.(Herring Bank)

Download the Lone Star App here: https://lonestarliving.hsidx.com/@sthomas

You're Always Home With Refind Realty!

FAQs

Q: What are typical closing costs for buyers in Dallas?

A: Buyers can expect to pay between 2% and 6% of the home's purchase price in closing costs.(Ramsey Solutions)

Q: Who pays for title insurance in Texas?

A: In Texas, it's customary for the seller to pay for the owner's title insurance, but this can be negotiated.(Herring Bank)

Q: Can I negotiate closing costs?

A: Yes, some closing costs are negotiable. Discuss with your real estate agent about potential concessions.

Q: Are home inspections mandatory?

A: While not mandatory, home inspections are highly recommended to identify potential issues with the property.

Q: What is included in escrow fees?

A: Escrow fees cover the services provided by the escrow company, including handling funds and documents during the closing process.

BLOG NAVIGATION

Contact Me By Filling Out

The Form Below

We Can Help You Reach Your Real Estate Goals!

Get In Touch With Me

Office 1229 E. Pleasant Run Ste 224, DeSoto TX 75115

Call :(713) 505-2280

Email: [email protected]

Site: www.stevenjthomas.com

Facebook

Instagram

X

LinkedIn

Youtube

TikTok