Refind Realty Blog

The Impact of Interest Rates on New Home Purchases

The Impact of Interest Rates on New Home Purchases

By Steven Thomas – Refind Realty

If you’ve been tracking interest rates lately, you’re not alone. Most of my buyers in the Dallas-Fort Worth area are wondering the same thing:

"Is it still a smart time to buy a new home with rates where they are?"

I'm Steven Thomas with Refind Realty. I help buyers make informed decisions—especially when the market feels uncertain. And right now, interest rates are influencing more than just your mortgage.

Here’s how rates affect monthly payments, builder incentives, and your ability to buy smart in today’s DFW new construction market.

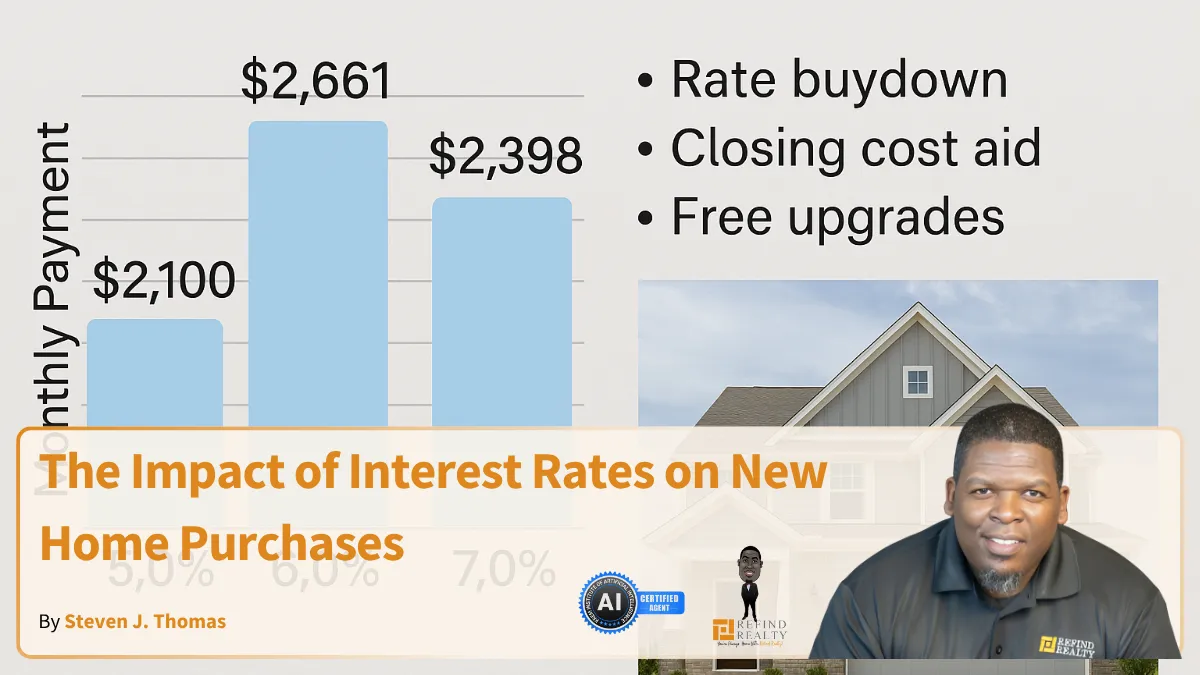

How Rates Affect What You Can Afford

Your home budget isn't just about price—it’s about your monthly payment. And when rates rise, so do those payments.

Here’s what that looks like on a $400,000 home:

At 5.5% interest: ~$2,271/month

At 7.0% interest: ~$2,661/month

That’s a $390/month difference—and nearly $140,000 more over the life of a loan.

Understanding your monthly payment range is key. I recommend starting here:

Get Pre-Approved to see where you stand with today’s rates.

Why Higher Rates May Actually Help You with New Construction

It might sound backward, but higher rates can actually benefit smart buyers—especially when you’re looking at new construction homes.

Here’s what I’m seeing across DFW:

Builders are offering more incentives to move inventory

Rate buydowns are making homes more affordable

Upgrades like appliances or closing cost coverage are back on the table

Want to see which builders are offering deals right now?

Explore my full Dallas-Fort Worth New Construction Homes guide.

Should You Wait for Rates to Drop?

Waiting might feel like the safe move—but it comes with trade-offs.

If rates drop:

Buyer demand increases

Home prices typically rise

Builder incentives often disappear

So yes, your rate may be lower—but the price of the home might be thousands more.

Instead of waiting, I help my clients buy smart now and refinance later. And for those building new, I cover timing strategies in my free New Construction Webinar.

Tools to Help You Buy Smart—Even With Higher Rates

You don’t need to wait for a rate drop to make a strong move. Here's what I offer to help you beat the market:

Custom rate buydown negotiations

Closing cost assistance from partnered builders

Personalized loan comparisons with trusted lenders

Use my New Construction Home Guide for step-by-step support through the building and buying process.

Real Client Example

I recently worked with a buyer in Grand Prairie who was able to secure a 6.25% fixed rate through a builder incentive—while others were paying closer to 7.5%. We also negotiated $10,000 in upgrades and full closing cost coverage.

Even in a high-rate market, there are still ways to win.

Final Thoughts from Steven

Interest rates will always fluctuate. What matters is making a move when it works for you—and using smart strategies to make the numbers work.

If you’re thinking about buying new, let’s talk through your budget, your timeline, and your options.

You're Always Home With Refind Realty.

Download the Lone Star App here

Search builder inventory, track rates, and access exclusive new construction offers.

FAQs: Interest Rates and Buying New Construction

1. Should I wait for lower rates before buying?

Not necessarily. Prices may rise faster than rates drop. You can always refinance later.

2. What is a buydown program?

Builders or lenders pay points upfront to lower your interest rate—sometimes temporarily, sometimes permanently.

3. Will I qualify for less with today’s rates?

Yes, most buyers qualify for a slightly lower purchase price when rates rise. That’s why it’s important to get pre-approved early.

4. How can I compare builder deals?

Use the Lone Star App to see real-time builder incentives, available homes, and floorplans across DFW.

5. Can I get a rebate on my new home purchase?

Yes. My Refind Realty Rebate Program puts money back in your pocket when you work with me to buy new.

BLOG NAVIGATION

Contact Me By Filling Out

The Form Below

We Can Help You Reach Your Real Estate Goals!

Get In Touch With Me

Office 1229 E. Pleasant Run Ste 224, DeSoto TX 75115

Call :(713) 505-2280

Email: [email protected]

Site: www.stevenjthomas.com

Facebook

Instagram

X

LinkedIn

Youtube

TikTok