Refind Realty Blog

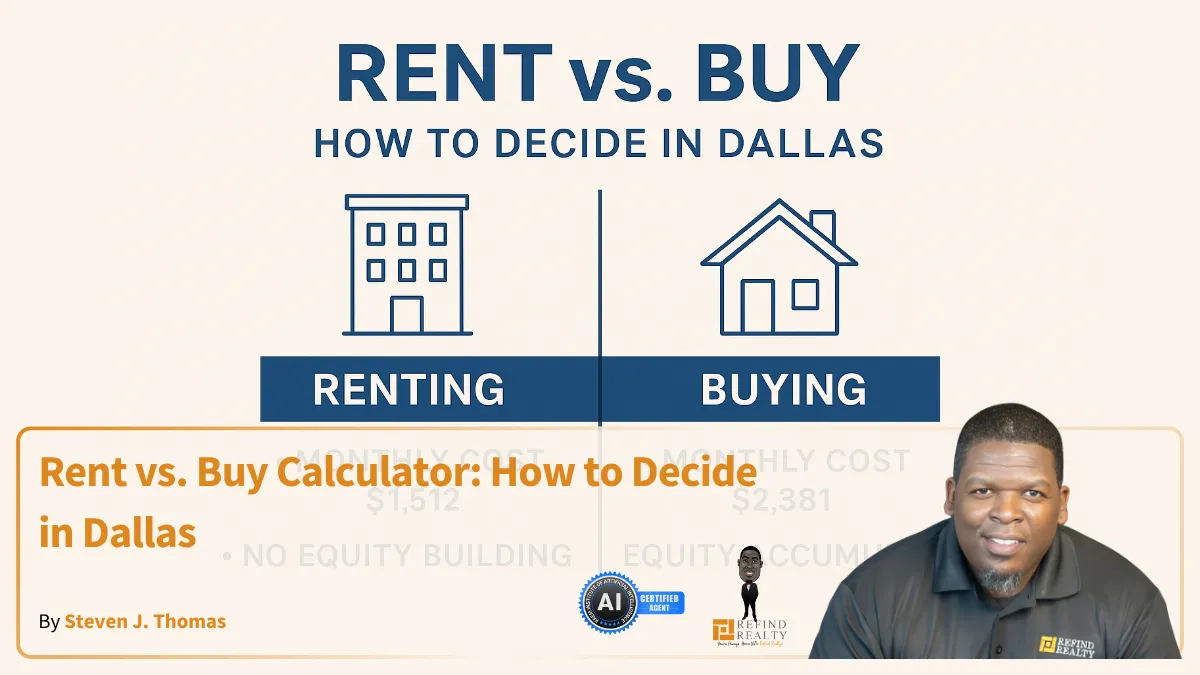

Rent vs. Buy Calculator: How to Decide in Dallas

Rent vs. Buy Calculator: How to Decide in Dallas

By Steven J. Thomas, Refind Realty

Introduction

In Dallas, the decision to rent or buy a home isn't straightforward. With rising home prices and fluctuating mortgage rates, it's essential to evaluate your options carefully. A rent vs. buy calculator can help you make an informed choice based on your financial situation and long-term goals.

Understanding the Dallas Market

As of early 2025, Dallas renters pay a median of $1,512 monthly, while homeowners face about $2,381 in housing costs—a difference of $869 per month. Additionally, buying a home in Dallas-Fort Worth now requires earning over $63,000 more annually than renting. (CultureMap Dallas, Axios)

Utilizing a Rent vs. Buy Calculator

Online tools like those from Realtor.com and Zillow allow you to input variables such as home price, rent, down payment, and expected duration of stay to compare the financial implications of renting versus buying.(Realtor)

Factors to Consider

Duration of Stay: If you plan to stay in Dallas for less than 5 years, renting might be more cost-effective.(Zillow)

Upfront Costs: Buying involves significant initial expenses like down payments and closing costs.(Calculator.net)

Monthly Expenses: Homeownership includes mortgage payments, property taxes, insurance, and maintenance.(Zillow)

Market Trends: Dallas home prices have been rising, but so have rents.

Pros and Cons

Renting

Pros: Flexibility, lower upfront costs, no maintenance responsibilities.

Cons: No equity building, potential rent increases, limited customization.(Better Homes & Gardens)

Buying

Pros: Equity accumulation, potential tax benefits, stability.(Trulia Real Estate Search)

Cons: High upfront costs, maintenance responsibilities, less flexibility.

Conclusion

Deciding whether to rent or buy in Dallas depends on various personal and financial factors. Utilizing a rent vs. buy calculator can provide clarity. For personalized advice, feel free to reach out.(Calculator.net)

Call to Action: Download the Lone Star App here: https://lonestarliving.hsidx.com/@sthomas

You're Always Home With Refind Realty!

FAQs

1. Is it cheaper to rent or buy in Dallas in 2025?

Currently, renting is generally more affordable, with renters paying about $869 less per month than homeowners. (mysanantonio.com)

2. What factors should I consider when deciding to rent or buy?

Consider your duration of stay, financial readiness, market trends, and personal preferences.

3. How does a rent vs. buy calculator work?

It compares the total costs of renting and buying over a specified period, factoring in variables like home price, rent, taxes, and maintenance.

4. Are there long-term benefits to buying a home in Dallas?

Yes, including equity building, potential tax advantages, and stability.(Better Homes & Gardens)

5. Can I get personalized advice on this decision?

Absolutely. Feel free to contact me for a detailed consultation tailored to your situation.

BLOG NAVIGATION

Contact Me By Filling Out

The Form Below

We Can Help You Reach Your Real Estate Goals!

Get In Touch With Me

Office 1229 E. Pleasant Run Ste 224, DeSoto TX 75115

Call :(713) 505-2280

Email: [email protected]

Site: www.stevenjthomas.com

Facebook

Instagram

X

LinkedIn

Youtube

TikTok