Should You Accept a Cash Offer on Your DFW Home?

Should You Accept a Cash Offer on Your DFW Home?

by Steve

Introduction: Cash Offers Are Tempting, But Should You Take One?

You're selling your home in Dallas-Fort Worth. A buyer offers cash. No loan. Fast close. Sounds like a dream—but is it the right move?

Cash offers are more common than ever in DFW. Investors, relocation buyers, and even big companies want in. But cash isn't always king. You need to understand the trade-offs before making a decision.

This guide will help you weigh the pros and cons, compare buyer types, and decide what makes sense for your goals.

Where Cash Offers Are Common in DFW

Certain DFW neighborhoods attract cash offers more than others:

In Dallas:

Oak Cliff – Popular with investors looking for flips or rentals.

Lake Highlands – Cash buyers seek older homes to renovate.

East Dallas – High demand for properties near White Rock Lake.

In Fort Worth:

Arlington Heights – Attracts buyers looking for quick transactions.

Tanglewood – Desirable schools draw investor attention.

Suburbs:

Frisco, McKinney, and Plano – Relocation buyers often come with cash.

Garland and Grand Prairie – Flippers and investors are active here.

Want to see what's available off-market in these areas? Download the Lone Star Living App now.

DFW Market Trends in 2025

29% of all DFW home purchases in Q1 2025 were all-cash.

Cash deals closed 57% faster than financed ones.

Sellers accepted 4%–7% below asking price for cash.

"Cash offers remove a lot of uncertainty. But they often come with a discount," says Steven Thomas, REALTOR® and local new construction expert.

More buyers are skipping financing to compete, but that speed comes at a price.

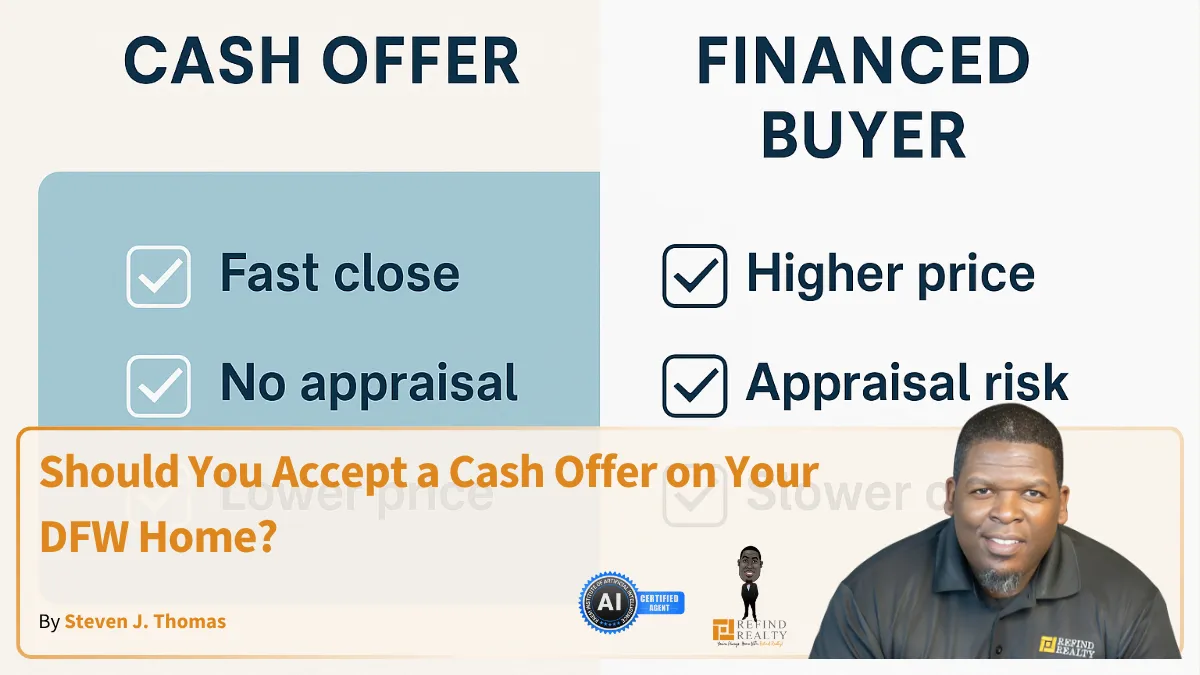

What You Gain—and Lose—With a Cash Offer

Pros:

Fast closing (7-14 days)

No lender delays

No appraisal requirement

Fewer contingencies

Cons:

Lower sale price

Reduced negotiation leverage

No chance of bidding wars

If you're trying to move quickly or sell a fixer-upper, cash may be ideal. If your priority is maximum value, you may want to wait.

What to Know If You Live in a New Construction Area

Homes in areas with new builds can be tough to sell unless you price aggressively. Cash buyers know this. In places like:

Windsong Ranch (Prosper)

Trinity Falls (McKinney)

Viridian (Arlington)

...cash buyers and relocation clients are active.

Want to understand your competition? Browse Dallas-Fort Worth New Construction Homes.

Also check out the New Construction Homes Rebate Program if you're selling and buying at the same time.

Alternatives to Traditional Cash Offers

You don’t need to choose between cash or nothing. Explore options that give you speed and value:

Get Pre-Approved buyers can close faster.

Bridge loans let you buy before you sell.

Services like Homeward and Knock offer hybrid cash-financing models.

Many sellers don't realize they can encourage competitive offers without accepting steep discounts.

Final Thoughts: Don’t Say "Yes" Too Fast

Cash offers bring speed and simplicity, but often at a cost. If you're in a rush, it might be worth it. But if you're trying to maximize your return, weigh your options carefully.

Get prepared with the Home Seller Checklist, or join one of our Home Seller Webinars to learn more.

Still unsure? Compare your sale options using the Home Seller Guides.

And if you're planning a move, don’t forget to Download the Lone Star Living App now to browse exclusive homes and rebates.

You're Always Home With Refind Realty!

FAQs: Answering Common Questions About Cash Offers

1. Do I have to accept the first cash offer I get?

No. Compare terms, timelines, and contingencies. You have options.

2. Can I negotiate on a cash offer?

Absolutely. Price, repairs, and closing timelines are negotiable.

3. Will I get more from a financed buyer?

Often, yes—especially for move-in-ready homes.

4. How do I know the buyer actually has the cash?

Ask for recent bank statements or verified proof of funds.

5. What if my home needs repairs?

Consider a cash offer, or explore Home Selling Options.

6. Should I work with a REALTOR® for a cash sale?

Yes. Your agent protects your interests and helps you compare all options. Start with your Home Seller Score.