Inflation’s Real Impact on DeSoto, TX Real Estate in 2025

Inflation’s Real Impact on DeSoto, TX Real Estate in 2025

By Steven J. Thomas

Introduction

Inflation affects everything—including how and when you buy or sell a home in DeSoto. With mortgage rates climbing and buyer power shifting, the local housing market is reacting in real time.

This post breaks down what inflation really means for you: rising costs, changing price trends, and smarter ways to navigate the market.

Want to get ahead? Tools like the Lone Star Living App, pre-approval strategies, and rebate programs can help you stay in control.

Neighborhood Spotlights: Where Buyers Are Still Looking

Even as rates rise, DeSoto remains attractive for its affordability and proximity to Dallas. Here's where interest remains strong:

Summit Park – Quiet streets, family homes, and park access.

Mantle Brook – Well-kept homes and strong resale value.

Mockingbird Hill – Competitive pricing and newer builds.

Windmill Hill – Higher-end homes, still under $500K.

Want to get a better feel for the latest inventory? Start with the Dallas-Fort Worth New Construction Homes page for homes near DeSoto that still qualify for builder incentives.

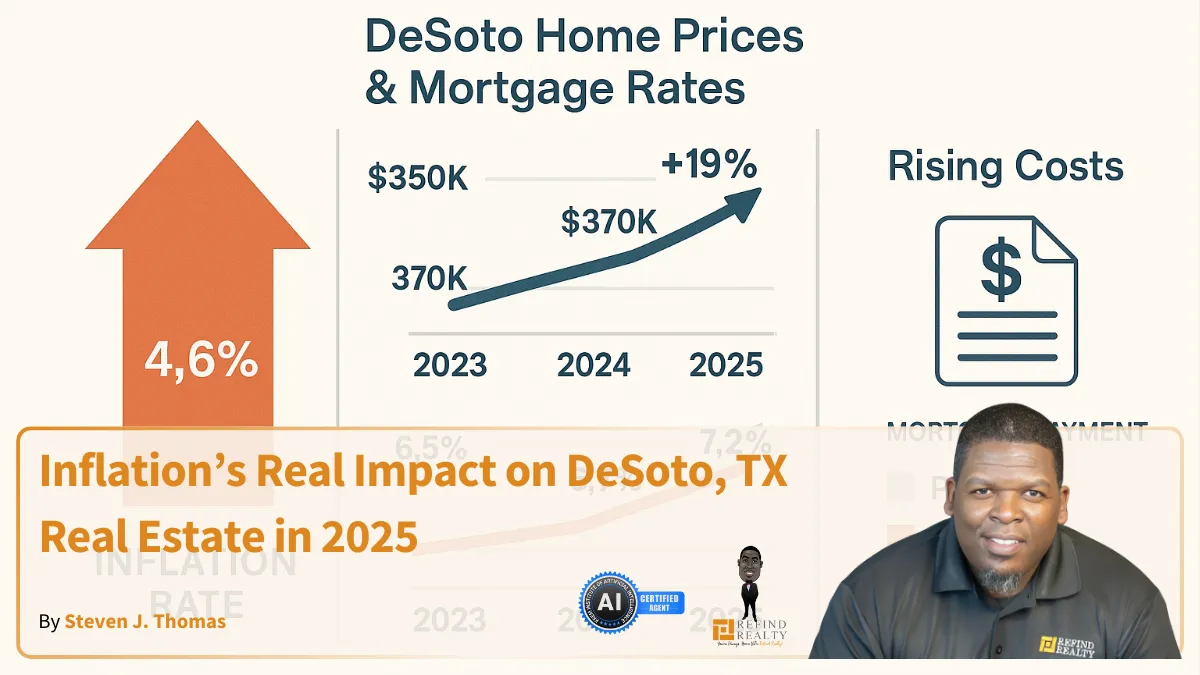

Local Market Trends: What's Really Going On?

Here’s what you need to know as of August 2025:

Zillow shows the average DeSoto home is worth $326,880, down 3.8% year-over-year.

Redfin reports a median sale price of $380K, up 19.8% year-over-year.

Homes are staying on the market for about 59 days, up from 42 days last year.

So, which is it—up or down? Both. Asking prices are still high, but buyers are pushing back. Closing prices reflect that softening. This trend mirrors what’s happening across the DFW area, especially in suburban markets like DeSoto.

For deeper insight into buying strategy right now, check out this New Construction Home Guide to understand what to expect before you buy.

Cost Breakdown: How Inflation Affects Home Affordability

Inflation isn’t just a news headline—it’s affecting every cost tied to real estate.

Here's how:

Mortgage rates are over 7%, the highest in 20+ years.

Building materials like lumber and concrete are still inflated from supply chain impacts.

Labor shortages keep construction timelines longer and more expensive.

Even if home prices cool slightly, higher rates mean your monthly payment goes up. That’s why you should always get pre-approved before you fall in love with a home. It gives you a clear picture of your true budget.

Builder & Community Insights: Where to Find Value

Most new construction in DeSoto has slowed, but communities just outside the city limits—like Cedar Hill, Glenn Heights, and Lancaster—are still active.

Here’s how to buy smarter:

Use the Refind Realty Rebate Program to get cash back when buying a new build.

Watch for builder incentives like rate buydowns or design credits.

Attend a free New Construction Webinar to learn about builders offering deals this quarter.

Financing & Incentives: Lock Before Rates Rise Again

Rates are volatile, and waiting might cost you.

Consider buying down your interest rate.

Use a lender who offers a float-down option.

Look for builders offering closing cost help.

The smartest move? Get pre-approved and lock your rate early. That’s the best way to fight inflation’s bite.

Conclusion: Inflation Isn’t the End—It’s Just a Factor

Don’t let inflation freeze your plans. Yes, costs are higher—but you have tools and choices.

Use the Lone Star Living App to stay informed. Explore new builds through the rebate program. Get pre-approved and know your range.

And if you’re selling?

Run your Home Seller Score and grab the Home Seller Checklist to prep fast.

Inflation doesn’t stop real estate—it just shifts the timing. If you're ready, you're still in a good position to make your move.

You're Always Home With Refind Realty!

FAQs: Inflation & DeSoto Housing Market

1. How does inflation affect mortgage rates?

The Fed raises rates to fight inflation. Mortgage rates follow, making your monthly cost go up.

2. Are prices still rising in DeSoto?

Redfin shows they're up, but Zillow shows sale prices are softening. Expect price cuts on overpriced listings.

3. Is it better to buy now or wait?

If rates rise again, buying later could cost more—even if prices drop. Get pre-approved now to know where you stand.

4. Can I still get a deal on a new home?

Yes—some builders offer incentives. Check out the rebate program and builder webinars.

5. What if I need to sell my home first?

Start with your Home Seller Score to evaluate timing and get personalized recommendations.

6. Is it cheaper to rent or buy right now?

Rent is rising too. Zillow reports the average rent in DeSoto is $1,984/month, up 5.6% in 2025. That’s often more than a mortgage.